November 27, 2023

The Corporate Transparency Act (CTA) was passed to enhance financial transparency and counter illicit financial activities, including terrorist financing and money laundering. As part of the legislation, certain entities are required to report beneficial ownership information to the Federal Crimes Enforcement Network (FINCEN). The purpose of the new report is to help the Department of Treasury more effectively identify where potential criminal behavior is occurring and investigate suspected crimes. The legislation will add new reporting requirements for Atlanta small and mid-sized companies to comply with in 2024 and 2025. To help clients, prospects, and others, Wilson Lewis has provided a summary of the key details below.

The CTA was enacted in January 2021 to combat financial crimes like money laundering and terrorist financing. This law mandates certain entities, mainly small and medium-sized businesses, to report beneficial owner information to FinCEN. Through the CTA, FinCEN can gather, protect, and share collected information with financial institutions and authorized governmental authorities under certain circumstances.

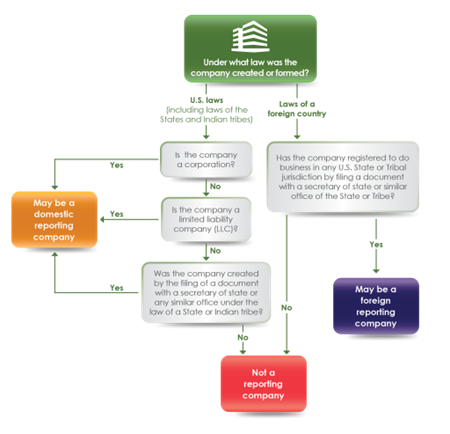

“Reporting Companies” that need to comply with the CTA include limited liability companies, corporations, and others. Entities are divided into domestic and foreign reporting companies. The details on each include:

Source: FinCen.gov

Generally, entities that are exempt from reporting are ones that already disclose beneficial ownership information because they are regulated by either federal or state governments. This includes insurance companies, financial institutions, broker-dealers, public utilities, accounting firms, and inactive entities. However, “large operating companies” may be exempt if there are a minimum of 20 full-time U.S. employees, gross revenue, or sales over $5 million on their prior-year tax return and operate out of a physical office in the United States.

Beneficial owners include individuals who control or own a minimum of 25% of the company’s ownership interests or someone who has “substantial control” over these interests, either directly or indirectly. Substantial control is another broad term that could mean senior officers, someone who can appoint or remove these officers, or someone who has substantial influence or control over important company decisions.

This means that even if the individual doesn’t have an equity interest in the company, they could be considered a beneficial owner if they have sufficient organizational authority. Understanding what substantial control may mean under the CTA is another determination that may require additional guidance.

For each beneficial owner, a reporting company will be required to provide the individual’s name, date of birth, residential address, and an identifying number from an acceptable identification document such as a non-expired U.S. or foreign passport of U.S. driver’s license. The reporting company will also need to submit an image of the identification document used to obtain the reporting number.

Entities that were formed or registered on or after January 1, 2024, will need to report the required information within 30 days of formation or registration. Any entities that were formed or registered before this date are required to report information by January 1, 2025. All reports must be submitted electronically through a secure filing system on FINCEN’s website. It is important to note there is no annual filing requirement. Companies only need to submit an initial report and an updated or corrected version when necessary.

The deadlines for the CTA are quickly approaching. Here are the steps companies should take to be prepared:

Contact Us

The new reporting requirements provide additional information necessary to counteract criminal activities. Since the mandatory reporting deadline is quickly approaching it is important to consult with a qualified advisor to determine how you will be impacted. If you have questions about the information outlined above or need assistance with a tax or accounting issue, Wilson Lewis can help. For additional information call 770-476-1004 or click here to contact us. We look forward to speaking with you soon.