October 19, 2018

As a company grows there are many challenges and opportunities that can present themselves. These may appear as the opportunity arises to expand operations, open a new location or begin offering an additional product or service to a captivated market segment. At the same time, there may be regulations to meet new compliance requirements such as a financial statement audit to satisfy a bank or new creditors. For those with a 401(k) or other plan such as a 457, 403b, there is the need to have an annual audit. This can be somewhat confusing for companies new to the process because there are specific rules dictating when a plan audit is required. In fact, we are often asked, do I need a 401(k) audit? The answer is determined by the information contained in the Employee Retirement Income Security Act of 1974 (ERISA) which established the guidelines for when an audit is required. To help clients, prospects and others understand when a benefit plan audit is required, Wilson Lewis has provided a summary of key considerations below.

What are the Plan Audit Requirements?

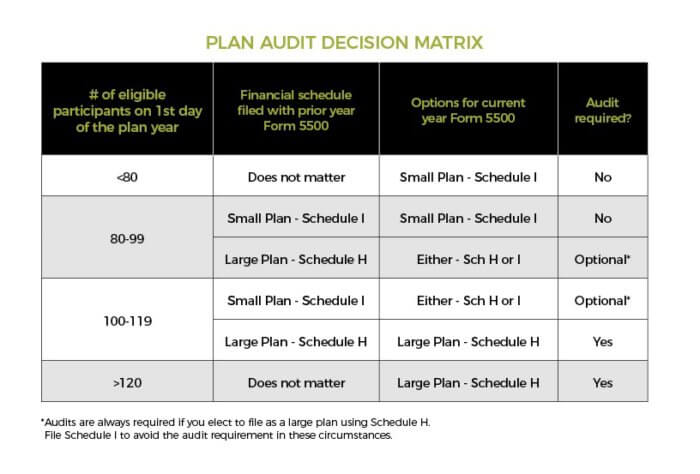

ERISA mandates that an annual financial statement audit be conducted by an independent public accountant once the plan has 100 or more eligible participants at the beginning of the plan year. The results of the audit need to be reported to the Department of Labor (DOL) on Form 5500 along with financial statements. Note that the audit must be conducted according to Generally Acceptable Accounting Principles (GAAP) and should include specific supplemental information.

What is an Eligible Participant?

An eligible participant is anyone that is permitted to participate in the plan as outlined by the plan documents. Each 401(k) can have different requirements that need to be met for an individual to become qualified. As a result, it’s essential to review your plan documents to determine your plan’s specific criteria. For many 401k plans, eligible participants often include the following:

What’s the 80/120 Rule?

While technically any plan with over 100 eligible participants is required to have an audit, there is a minor exception granted under the 80/120 rule. The rule allows plans with less than 100 eligible participants at the beginning of the prior year to exempt from the audit requirement if they have less than 120 eligible participants at the beginning of the current year. In this situation, an audit will not be required until the plan exceeds 120 eligible participants.

Contact Us – Atlanta 401k Auditor

The rules and regulations surrounding when a 401(k) or other benefit plan audit needs to be conducted are complex and can often be confusing. It’s a good idea to consult with a qualified advisor who can review your situation and determine the best steps. If you have questions about whether you need a 401(k) audit, or need assistance with your benefit plan audit, Wilson Lewis can help! For additional information call us at 770-476-1004 or click here to contact us. We look forward to speaking with you soon.