June 18, 2024

The Corporate Transparency Act was passed in 2021 and became effective on January 1, 2024. The legislation aims to increase financial transparency and counter illicit financial activities, including money laundering and terrorist financing. To comply with the new regulations, many business owners are required to report Beneficial Ownership Information (BOI) to the Federal Crimes Enforcement Network (FinCEN). This includes personally identifiable information (PII) of each business owner, including taxpayer identification number, amongst other data points. The information is required to be submitted electronically on the FINCEN website.

While it is easy to submit the necessary information, it has also become a target for scammers. Several scams have been reported targeting business owners unfamiliar with the filing process. These include correspondence requesting payment, prompting the use of a false website or QR code, and a request for information from the US Business Regulations Department. These are all fake, and business owners should avoid falling victim. To help clients, prospects, and others, Wilson Lewis has summarized the key details below.

There are several types of scams currently being reported by FINCEN. In all cases, the bad actors are attempting to gain access to personal information only to later use it for fraudulent purposes. These include:

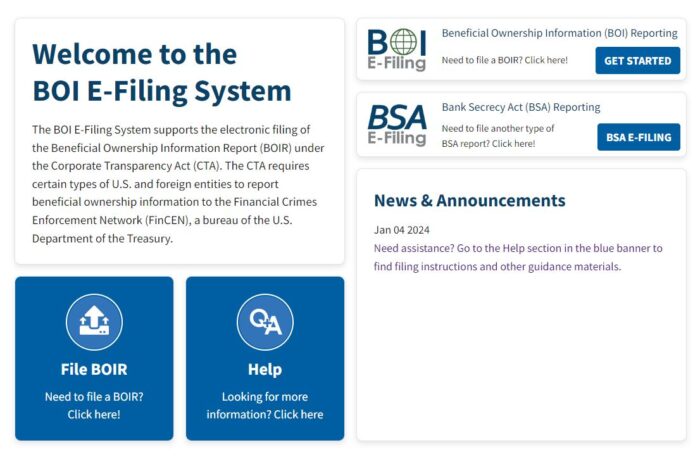

Relevant data must be reported through the FINCEN website using the BOI E-Filing System. There are two ways to file BOI information, including a PDF submission using the agency’s digital form. Submitting a PDF is straightforward; the filer completes the form, submits it, and then downloads a transcript upon completion. The other requires all information to be submitted through a secure online form. When completed, the filer can download a copy of the filing transcript.

Contact Us

The Corporate Transparency Act requires many business owners to report Beneficial Ownership Information (BOI). Unfortunately, bad actors have unleashed several scams designed to steal your personal information (including Social Security Number or Taxpayer ID). Before responding to any communication, carefully consider its validity. If you have questions about the information outlined above or need assistance with another tax or accounting issue, Wilson Lewis can help. For additional information, call 770-476-1004 or click here to contact us. We look forward to speaking with you soon.